Following the Money in MFM Nonprofits

and Money Laundering in Other Nonprofits (DON'T DO IT!)

Much has been said about the ginormous amount of money being funneled through nonprofits (NP). Yes, it happens. They can hide their financial data as some nonprofits in the Medical Freedom Movement are doing - I stopped donating to some 501c3s due to their lack of transparency.

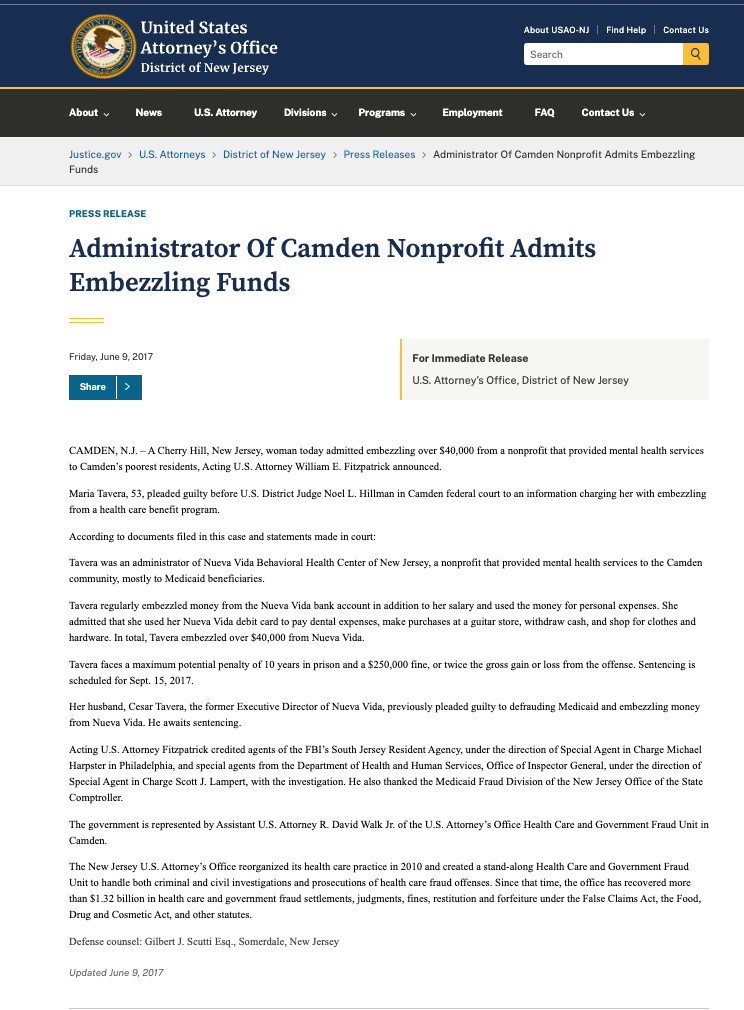

Yes, money laundering, fraud, corruption occurs in the nonprofit world. Below are some parasites who got caught stealing cash that didn’t belong to them. Don’t do it. Don’t steal from the needy.

I’ve selected a couple of nonprofits within the “MFM” because I’ve been observing their activities for a while. My experience with nonprofits has prompted me to “follow the money” and the final result is disappointing. When you hear these “leaders” talk about transparency, they obviously don’t consider themselves or their organizations - they hide their financial data through their NPs.

Money Laundering in Nonprofits

“ it's corporate money that just happens to be flowing through nonprofits. The nonprofits are, in effect, laundering the corporate money.”

When you think of money laundering, trust and integrity are not what comes to mind. Yet trust and integrity are the calling cards of nonprofits.

My colleague from Stanford's Center on Philanthropy and Civil Society, Professor Rob Reich, is a smart political theorist. He even makes tax incentives interesting. For a long time Rob has been asking whether the "blunt tool" of tax exemption is right for all charitable giving.

On a recent panel discussion with Rob I realized that the post "Citizens United year" may well give us the opportunity to revisit that structure. Rob said something akin to "After Citizens United was decided by the United States Supreme Court this January, we expected to see huge corporate dollars flow into politics. What we're seeing is nonprofits playing the big funding role."

I hadn't seen it that way. To me, it's corporate money that just happens to be flowing through nonprofits. The nonprofits are, in effect, laundering the corporate money. Yes, that's strong language. Intentionally. Now that the law of the land allows corporations unlimited spending on campaigns, why else would they bother to move the money through nonprofits unless they want to mask their involvement? The lack of transparency around these organizations provides the donors with unfettered funding opportunities while letting them hide their identities (except when four intrepid reporters spend countless hours digging through document trails). When these nonprofits then spend 50 percent or more of their money on issue and political ads, it's hard to see them as anything but shills for that money. To me, that's money laundering.

The crooks who got caught stealing:

“Tavera regularly embezzled money from the Nueva Vida bank account in addition to her salary and used the money for personal expenses. She admitted that she used her Nueva Vida debit card to pay dental expenses, make purchases at a guitar store, withdraw cash, and shop for clothes and hardware. In total, Tavera embezzled over $40,000 from Nueva Vida.”

Misuse of the Non-Profit Sector for Money Laundering and Terrorism Financing

NCJ Number 236090

Samantha Bricknell

September 2011

After examining money laundering and terrorism financing (ML/TF) risks to the Australian nonprofit sector, this paper documents cases in which this has occurred and assesses Australia's response for countering ML/TF through nonprofit organizations

How are nonprofits funded?

Nonprofits can and do use the following sources of income to help them fulfill their missions:

Fees for goods and/or services

Individual donations and major gifts

Bequests

Corporate contributions

Foundation grants

Government grants and contracts

Interest from investments

Loans/program-related investments (PRIs)

Tax revenue

Membership dues and fees

While opinion varies as to what a nonprofit's "ideal" mix is, using several different sources to achieve sustainability is generally a good practice. The National Center for Charitable Statistics' Nonprofit Sector in Brief 2014 provides a pie chart showing the percentages of various sources of nonprofit revenue:

501c3 Donation Rules | Know All Requirements and Best Practices

Individuals and companies that donate to a 501c3 public charity can deduct up to 60% of their AGI. This is not the only rule and regulation the IRS has regarding 501c3 donations. In this article, we’ll help clear up any questions you may have about donating to and from a 501c3, along with exemption restrictions and passthrough donations.

Updated September 05, 2023

2. Donating as a 501c3

Some specific rules and regulations must be followed when it comes to 501c3 organizations donating to other organizations. A 501c3 organization can give to another nonprofit. An example of this is a private foundation providing funds to another 501c3 charity. This contribution is commonplace, but before donating, it is vital to ensure your donors would approve of the donation and that the other organization is free from scandal.

In addition to 501c3 organizations, 501c3 nonprofits can also donate to 501c4 organizations. These contributions must be used for charitable purposes, and no amount can be used for political activities. When donating to a 501c4 organization, it is essential to know how the gift is used. 501c4 organizations do not have as many restrictions when it comes to political activity. If your gift is used for any of these activities, you may be in danger of losing your tax-exempt status.

501c3 organizations cannot donate to political campaigns.

501c3 organizations can donate to individuals, but these contributions must be made as grants or scholarships. When offering financial support to an individual, a 501c3 organization must award these gifts to a class of individuals and include an application process for those who would receive the gift.

Researching the Funding of Nonprofits

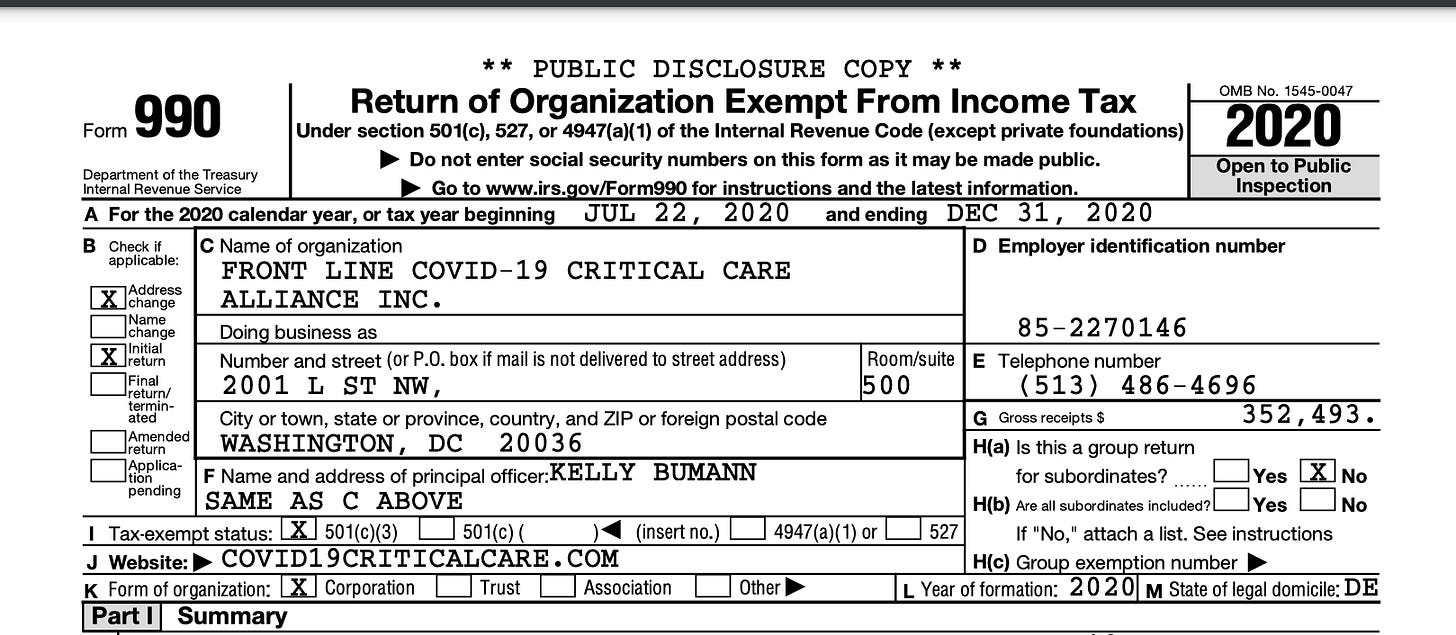

Where to start? Visit the nonprofit’s website and search for their financial data - download their IRS 990 tax returns and audited financial statements, if they’re available. For example, let’s start with the FLCCC Alliance:

When were they founded, who are the founders and how much did each founder contribute initially?

Founded by a group of leading critical care specialists in March 2020, the Front Line COVID-19 Critical Care Alliance (FLCCC) is dedicated to helping prevent and treat COVID, and to help patients take charge of other areas of their health. (Domiciled in Delaware, interesting).

When were they granted their nonprofit status? July 22, 2020 (a speedy approval, they must have excellent, well connected attorneys).

The founders, according to their website:

Initial funding is a secret (not all founders made donations?):

In 2020, there were no salaries or compensation:

However, in 2021 this young nonprofit experienced exponential growth and thus expanded their Board of Directors and were able to pay modest salaries. Please note addition of Jeff Hanson, Keith Berkowitz and Chris Martenson, who are also part of The Unity Project. (According to Robert Malone, Jeff Hanson wrote him a big check, allowing him to travel and be a hero.)

I didn’t see detailed information on the non-personal donors for 2021 on their 990 but did find donor data in The Unity Project’s 20221 990 ( below):

Another new nonprofit, The Unity Project, donated $100,000.00 to FLCCC / Defeat the Mandates. You may notice that some of the entities listed below share the same address. Perhaps because they were also very new and didn’t have a permanent address.

Also funding FLCCC, according to a website that keeps track of nonprofit financials (link in screenshot):

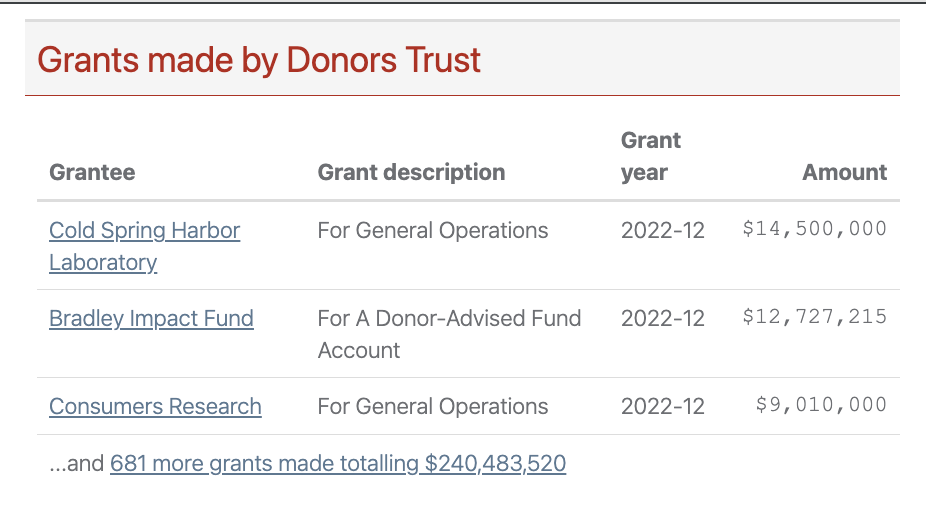

Donors Trust (in 2022, according to their 990):

Donors Trust also funded:

They donated $14,500,000 to COLD SPRING HARBOR LABORATORY - doesn’t have research on this laboratory? I think Mark does, he’ll be surprised to find out that an organization that has gifted almost $1,000,000 to FLCCC also funds Cold Springs Harbor Laboratory.

And the world famous Vanguard:

Vanguard was also very generous with Children’s Health Defense:

Vanguard’s 990:

Who is Vanguard?

MONOPOLY - WHO OWNS THE WORLD?

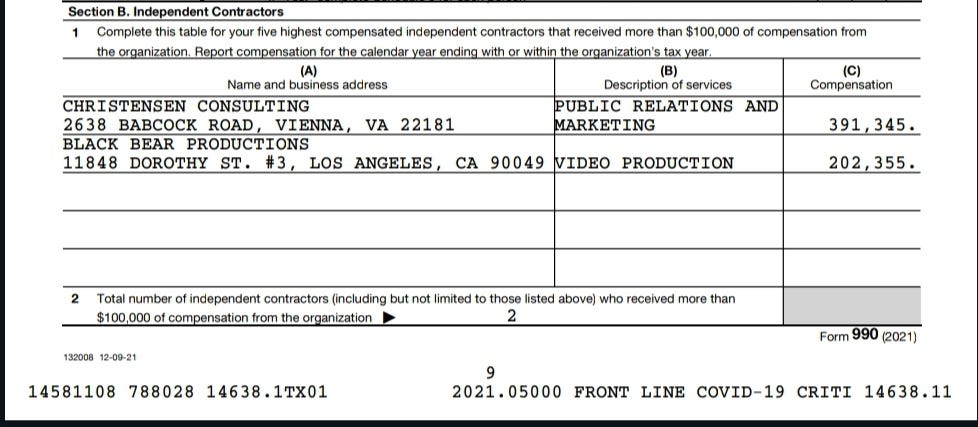

Back to the finances / expenses:

I understood that Trevor FitzGibbon represented Dr. Kory (as well as Malone, Kirsch, Urso, McCullough, Kennedy) - but Silent Partners isn’t listed in the 990 as a contractor (it is listed in Kennedy’s campaign reports). These same individuals are part of a web (The Unity Project, FLCCC, The Wellness Company, DMED, etc….) - it’s a party and you ain’t invited.

“…..the main thing that was just you know dr corey talks about it dr urso and 32:32 dr mccullough these are three doctors that some of the folks i work with they're like this is 32:38 the first pandemic in modern history where you go to the hospital 32:46 and they won't treat you even though you have it because you're not sick enough 32:54 and then they tell you to go away but you don't get anything you don't get any treatment that's 33:01 insanity this was actually one of the most frustrating things for me”

Inquiring minds want to know how these new “nonprofits” succeeded at increasing their revenue so quickly. Did Robert Malone connect Dr. Pierre Kory with Jeff Hanson who connected him to the DMED crypto bros, Donors Trust, Vanguard? Dr. Berkowitz is also connected to The Unity Project. Why are these same doctors (Kory, McCullough, Risch, Malone, Berkowitz) recycled from one organization to the other? When do they have time for patients? (Malone says he’s never seen a patient).

The Charitable Sector is Vital to the Nation’s Economy, y’all!

“As the third largest private employer and nearly six percent of the country’s GDP, the charitable sector is vital to the nation’s economy and the welfare of those we serve”

Read the 2022 Independent Sector Annual Report.

2022 was a watershed year of reflection, change, and transition — for our nation, for the charitable sector, and for Independent Sector.

As the third largest private employer and nearly six percent of the country’s GDP, the charitable sector is vital to the nation’s economy and the welfare of those we serve — especially people most marginalized in our society. And as the vital meeting ground of the U.S. charitable sector, Independent Sector plays a key leadership role in lifting up and promoting the well-being and care of the nonprofit workforce.

In 2022, we focused our efforts on building the capacity of sector leaders and organizations through our Community Building work; assessing sector trends and data in our Sector Health work; and advocating on behalf of our leaders, organizations, and communities through our Public Policy efforts.

Highlights included advancing the “Seat at the Table” initiative, launching our inaugural Bridging Fellows program, and issuing reports on the health of the U.S. nonprofit sector and trust in civil society. We also strengthened engagement with 1,500 sector leaders through three virtual Upswell Pop-Ups and through our virtual Upswell Summit.

Among our biggest changes in 2022 was our leadership transition. After boldly leading Independent Sector for six years, Daniel J. Cardinali announced he would step down. Following a national search by our Board of Directors for a new leader for the next era of IS, Dr. Akilah Watkins, a national expert on equity, policy, and community development, was named Independent Sector’s next president and CEO — the first Black woman to lead Independent Sector in its 43-year history.

Read more about Independent Sector’s accomplishments in 2022 in the annual report.

State level regulations:

State level info, great resource for nonprofits data

Three Models of US State-Level Charity Regulation

George E. Mitchell

From the journal Nonprofit Policy Forum

https://doi.org/10.1515/npf-2022-0051

Abstract

The existence of federal oversight of charitable organizations in the United States implies a degree of uniformity to US charity regulation. However, charity regulation is far from uniform across the country. States differ significantly in their adoption or non-adoption of various state-level regulatory requirements, creating not one but many different regulatory environments for charities. The complexity and diversity of these regulations has made it difficult for sector stakeholders, such as researchers, regulators, practitioners, information intermediaries, and donors, to understand the nature and significance of state-level charity regulation from a comparative perspective. To address this problem, this article employs latent class analysis to identify three distinct models of state-level charity regulation: broad regulation, limited regulation, and asset oversight. Subsequent analysis identifies relationships between a state’s economic, social, and political characteristics and its model of charity regulation, suggesting new avenues of research for understanding regulatory model emergence. Many additional practical applications of the typology are also discussed.

Thanks for this article still reading links but it is curious how all these folks connect in March 2020 never seeming to have been connected or known each other before covid. Or are they all CIA operatives in place to “deal” with the free thinkers who are not climbing on the Covid propaganda wagon. Strange bed fellows, not sure they are all are legitimately what they present themselves as. Especially with the TLC company monitoring post covid vaccine treatments so aggressively. Planned support as a means to help those injured when the government and main stream medicine ignores them or do they - FLCCC could also be propaganda to mislead the reluctant to accept treatment that has not been proven efficacious. Are we meant to never trust anyone. There is no such thing as real altruism in the 21st century when the non-profits are so heavily funded by corporations who probably control the deep state and helped bring the plandemic to fruition.

Thanks for this post. I had reviewed the 990s for FLCCC not long ago and mare similar observations to myself :)

You are correct that the approval from the IRS is VERY speedy, indeed.

Regarding Dr Kory, it’s curious to me that the Med school from which he graduated posted this “advertisement” about him on March 3, 2020. Well-timed.

https://www.sgu.edu/news-and-events/intensivist-dr-house-grooms-aspiring-doctors-for-future-success/

IMO, the Early Treatment narrative was conceived as a counter-op before Operation COVID fully commenced in the eyes of the public.

ET is still pro-Govt narrative because it does not question that a deadly coronavirus was suddenly spreading